4 Government-Nonprofit Relationships

Learning Objectives

After reading this chapter, you should be able to:

- Understand the ways nonprofit organizations interact with government.

- Understand the theory of government-nonprofit relationships.

- Gain practice considering the challenges and opportunities involved when a nonprofit works closely with government.

Image: “Providing hygiene kits to families as they return home” by DFID – UK Department for International Development is licensed under CC BY 2.0.

4.1 Chapter Introduction

Many nonprofit organizations work closely with government at the federal, state and local level in the United States. International nonprofits may work closely with their own federal governments, the governments where they work or international agencies like the United Nations or International Monetary Fund. Alternatively, organizations may work in conflict with government(s) through their advocacy efforts. This chapter covers the different ways nonprofit organizations interact with government and government agencies, from close partners to adversaries.

4.2 Shape(s) of Nonprofit-Government Relationships

Relationships between nonprofit organizations and governments take many forms in both theory and practice. These relationships may include:

- Contracts.

- Grants.

- Third-Party Payments.

- Tax-deductions and Tax Exemptions.

- Joint Ventures (Public-Private Partnerships).

- Privatization.

- Advocacy.

- Policy change.

4.3 Nonprofit organizations as partners to government

As discussed in Chapter 2, the nonprofit sector has a crucial role in providing much needed services and programs that government is either not able or willing to organize itself. However, government often provides funding – through grants and contracts – that supports the delivery of public goods and human services by nonprofit organizations to the public. This requires a close partnership between government and nonprofit organizations.[1] In Chapter 2, we called that interdependence theory; government depends on the nonprofit sector to deliver services, while the nonprofit sector depends on government for funding.

The following examples demonstrate the many ways government and the nonprofit sector work together.

Tax Deductions and Tax Breaks

Almost all organizations in the nonprofit sector interact with government through tax exemption. The U.S. federal government forgoes literally billions of dollars in tax revenue every year by allowing most nonprofits to be exempt from paying taxes on their revenues. Most state and local governments also extend tax exemption to nonprofits in their jurisdictions. In exchange, nonprofits agree to a few rules, including: 1) acting in the public interest, 2) being transparent about finances and 3) having a board of directors that will provide oversight of the organization. These requirements ensure shared leadership of nonprofit organizations and allow public scrutiny of their finances.[2]

Privatization

Sometimes government steps back from providing a service altogether, turning the services and programs over to the private sector (both businesses and nonprofits). Privatization is “the act of reducing the role of government or increasing the role of the private institutions of society in satisfying people’s needs; it means relying more on the private sector and less on government.”[3] Governments often engage in privatization measures in order to “shrink” the size of government, find new efficiencies and save taxpayer dollars. There are different types of privatization efforts, from grants and contracts to full divestment.[4]

- Contracts. The United States federal government, states and local governments enter contracts with external vendors, including nonprofit, for-profit and other government agencies, to carry out its work. Contracts are the “mutually binding legal relationship obligating the seller [contractor] to furnish the supplies or services (including construction) and the buyer [federal government] to pay for them.”[5]

The nonprofit sector receives billions of dollars annually through federal, state and local contracts to deliver particular services, projects and programs that the government is, by law, required to provide. Among nonprofits, healthcare nonprofits have the highest proportion of contracts, followed by organizations focused on the environment and animals and other social services.[6]

Discussion

In some cases, government opts to allow private organizations to take over a service typically administered by government. This is called contracting out. For example, in 2022, Hillsborough County in Florida contracted out their entire child protective services to a nonprofit, The Children’s Network of Southwest Florida. Interestingly, the organization didn’t submit their own bid for the contract. Instead, the state recruited them to provide the service.

Read the article linked above and answer the following questions:

- What is the goal of government wanting to contract out child protective services to a nonprofit rather than doing it themselves?

- Why might the nonprofit be interested in providing the service? What challenges might they face?

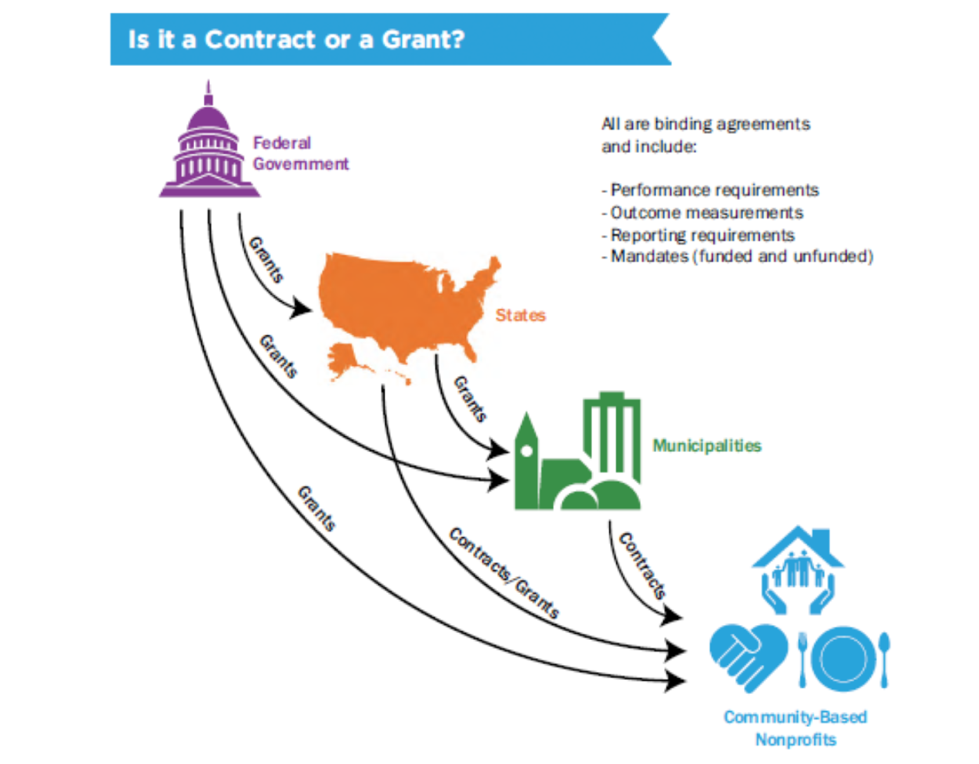

- Grants. On the other hand, grants are “authorized expenditure[s] to a non-federal entity for a defined public or private purpose in which services are not rendered to the federal government.”[7] Grants are usually given for a specific purpose to benefit project or program development in organizations. They do not have to be paid back. While most federal grants are provided to state and local governments, some nonprofit agencies are able to apply for them. In addition, nonprofits often compete for grant funding from their states, counties and municipalities as well. The below graphic[8] shows how the federal government, state and local agencies and nonprofit organizations interact in terms of grants and contracts.

Public-Private Partnerships (PPP)

PPP occur when government agencies and nonprofit or for-profit organizations collaborate to jointly define and develop a product, project or service. PPP are one way that organizations help to leverage the finances, management, ideas and leadership available across the three sectors.[9]

The San Diego Regional Policy & Innovation Center is a new partnership between the County of San Diego, CA, the San Diego Foundation and the Brookings Institution, a leading nonprofit think tank. It was founded in 2021 and, as its own nonprofit organization, is designed to: “develop, test and implement world-class research and policy-driven solutions to address our region’s most pressing challenges. We use applied research to help local leaders identify catalytic policies, programs, and interventions and attract greater capital to the region.” Read the following article about San Diego Union Tribune.

- What is the Policy and Innovation Center seeking to do?

- Why do they feel like their approach as a Public-Private Partnership is the right one to solve social issues?

4.4 Benefits and Challenges of Nonprofit-Government Partnerships

An outstanding question is: why do government and nonprofit organizations seek partnerships, whether through collaboration or contracts and grants?

A government agency may want to partner with nonprofit organizations to help cut costs to taxpayers. This contracting out has been a trend in government over the past several decades. Whether it’s a desire to “shrink the size” of government or identify competencies and expertise not held by the agency, contracting out aims to ensure that the program is being provided without government having to undertake it.[10]

Government agencies may also be interested in working through nonprofit agencies to leverage the nonprofit’s positive community reputation, particularly among constituencies that may be otherwise hard to reach – such as immigrants or the unhoused population. In some ways, this can be seen as government understanding Contract Failure from Chapter 2 and using this to its advantage in delivering a public service.

Nonprofits, on the other hand, may look forward to the additional financial resources of partnerships, allowing them to grow their organizations, build their capacity to do more work and provide financial stability. They may also enjoy more influence among policymakers or over policy processes and gain further legitimacy with other donors.

However, these relationships can be challenging. For one, contracting out services to third parties can make identifying lines of accountability difficult when something goes wrong; each side can easily blame the other. Additionally, nonprofits may find the added burden of additional red tape – usually through oversight or filing reports and updates – difficult to manage effectively. Nonprofits may also find themselves working on issues outside their stated mission (sometimes called mission drift).

Mission drift, or mission creep, has often been seen as a bad thing[pdf] to be avoided at all costs by the nonprofit sector. Although it’s true that organizations may become stretched too thin, and even end up engaging in activities not aligned with their mission statement, some scholars have recently started to encourage nonprofit leaders to think more critically about the issues of “mission drift” in their organizations. Read this article on MissionMet.com. Consider the following questions:

- Why do some people think that mission drift shouldn’t be avoided at all costs by organizations?

- What are the downsides of strictly adhering to a mission? Or developing a very narrow mission?

- How should managers think about mission drift instead?

Image Source: “Critical Practice logo” by neil cummings is licensed under CC BY-SA 2.0

4.5 Nonprofits as Advocates and Adversaries to Government

Although many nonprofits work closely with government agencies to implement programs and public services, many nonprofits also engage in advocacy efforts. Advocacy is “speaking or acting on the behalf of others.”[11] Chapter 7 discusses nonprofit advocacy in much more detail.

Advocacy, and even lobbying, isn’t just undertaken by “political” organizations. Nonprofit organizations engage in advocacy for many reasons, including to: advocate for public funding to support certain organizations and issues; raise awareness within the communities they work with; help refine or change existing public policy to better serve their constituents; lobby for policy change at the local, state, federal or international levels; and help people understand policy issues and connect them to their representatives.

A lot of advocacy efforts can be adversarial, with organizations challenging government agencies and legislatures to be more responsive to social issues and problems. However, advocacy can also be participation in political processes, including serving on local commissions and committees or working with government agencies to define a new grant proposal process. In these ways, nonprofit organizations can be involved in policy processes and changes at all different levels of government.

Advocacy in Action

Watch the first few minutes of Keenya Robertson testifying (click this link or watch the above video at the 19 min mark) before the U.S. House of Representatives Committee on Appropriations in 2019 (start at about the 22 minute mark). Mrs. Robertson is the Board Chair of the National Fair Housing Alliance and President and CEO of Housing Opportunities Project for Excellence, Inc. Consider the following questions:

- What is Mrs. Robertson’s priority?

- What is she asking Congress for?

- Did she share information about the problems faced by the people her organization serves? How did she do that?

- R. Smith and Kirsten A. Grønbjerg, “Scope and Theor of Government-Nonprofit Relations,” in The Non-Profit Sector: A Research Handbook, ed. W. W. Powell and Richard Steinberg, Second (New Haven, CT: Yale University Press, 2006), 221–42. ↵

- Candid Learning, “Trainings in Nonprofit Fundraising, Proposal Writing, Grants,” Candid Learning, accessed May 2, 2022, https://learning.candid.org/resources/knowledge-base/pros-and-cons; ↵

- E S Savas, Privatization and Public-Private Partnerships (Chatham, NJ: Chatham House, 2000), 2. ↵

- Savas, Privatization and Public-Private Partnerships. ↵

- “Part 2 - Definitions of Words and Terms | Acquisition.GOV,” Acquisition.Gov, accessed April 7, 2022, https://www.acquisition.gov/far/part-2. ↵

- Sarah L Pettijohn and Elizabeth T Boris, “Contracts and Grants between Nonprofits and Government,” 2013, 8. ↵

- USASpending.gov, “Glossary,” accessed May 2, 2022, https://usaspending.gov/. ↵

- National Council of Nonprofits, “Toward Common Sense Contracting: What Taxpayers Deserve” (Washington, DC: National Council on Nonprofits, 2014), https://www.councilofnonprofits.org/sites/default/files/documents/toward-common-sense-contracting-what-taxpayers-deserve.pdf. ↵

- STUART C. MENDEL and JEFFREY L. BRUDNEY, “PUTTING THE NP IN PPP: The Role of Nonprofit Organizations in Public-Private Partnerships,” Public Performance & Management Review 35, no. 4 (2012): 617–42. ↵

- Anna A. Amirkhanyan, “Monitoring across Sectors: Examining the Effect of Nonprofit and For-Profit Contractor Ownership on Performance Monitoring in State and Local Contracts,” Public Administration Review 70, no. 5 (2010): 742–55, https://doi.org/10.1111/j.1540-6210.2010.02202.x; Michael Lipsky and Steven Rathgeb Smith, “Nonprofit Organizations, Government, and the Welfare State,” Political Science Quarterly 104, no. 4 (1989): 625–48, https://doi.org/10.2307/2151102. ↵

- Kelly LeRoux and Mary K Feeney, Nonprofit Organizations an Civil Society in the United States (New York: Routeledge, 2015). ↵